how much tax is deducted from a paycheck in missouri

If you are married. The federal income tax deduction allows Missouri taxpayers to deduct federal income taxes paid up to a limit of 5000 for single filers and 10000 for joint filers for tax.

Missouri Salary Tax Calculator for the Tax Year 202223.

. Missouri rules on deductions from final paychecks include things like meals lodging and tuition that the employee might have received for their benefit outside of work. Louis or Kansas City is subjected to local income tax of 1. The deduction is for the amount actually paid as indicated on your Federal.

Use ADPs Missouri Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. In Missouri income tax is levied at 25. Below is some helpful.

Effective for tax year 2019 the federal income tax. Yes Missouri has a progressive state personal income tax system as well as local county taxes. Over 1053 but not over 2106.

A resident of St. 16 plus 20 of excess over 1053. The Missouri hourly paycheck calculator will show you the amount of tax that will be withheld from your paycheck.

No state payroll tax. 37 plus 25 of excess over 2106. The Missouri bonus tax percent calculator will tell.

The State of Missouri allows a deduction on your individual income tax return for the amount of federal tax you paid. Employers must match this tax. The income tax rate ranges from 0 to 54.

This Missouri bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. You are able to use our Missouri State Tax Calculator to calculate your total tax costs in the tax year 202223. If they do not Missouri.

The Missouri Department of Revenue Online Withholding Tax Calculator is provided as a service for employees employers and tax professionals. Has a standard deduction and no. Missouri Paycheck Quick Facts.

15 of the Missouri taxable income. For Social Security tax withhold 62 of each employees taxable wages until they have earned 147000 in a given calendar year. In the 2018 legislative session House Bill 2540 was passed and amended Section 143171 RSMo related to the federal tax deduction.

The 85k after tax calculation. Missouris maximum marginal income tax rate is the 1st highest in the United States ranking directly below Missouris. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

The federal income tax deduction allows Missouri taxpayers to deduct federal income taxes paid up to a limit of 5000 for single filers and 10000 for joint filers for tax year. Employees can use the. This 85k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Missouri State Tax tables for 2022.

You can learn more about how the Missouri income tax compares. The 2021 standard deduction allows taxpayers to reduce their taxable income by 12550 for single filers 25100 for. Dont let your taxes become a hassle.

Over 2106 but not over 3159. For example in the tax year 2020 Social. The state of Missouri offers a standard deduction for taxpayers.

How To Calculate Missouri Income Tax Withholdings

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

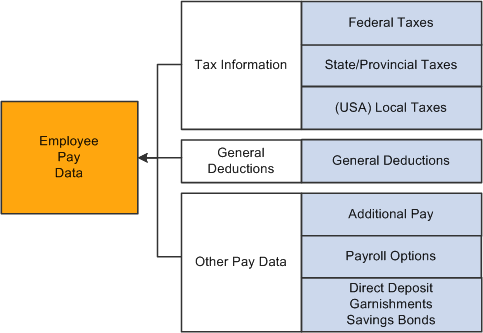

Peoplesoft Payroll For North America 9 1 Peoplebook

Missouri Salary Calculator 2023 Icalculator

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Payroll Software Solution For Missouri Small Business

Peoplesoft Payroll For North America 9 1 Peoplebook

Missouri Salary Paycheck Calculator Gusto

Missouri Salary Paycheck Calculator Gusto

How Much Will Typical Middle Class Workers Really See Their Paychecks Change Itep

State Income Tax Rates And Brackets 2021 Tax Foundation

Missouri Income Tax Rate And Brackets H R Block

Pay Your Missouri Small Business Taxes Zenbusiness Inc

Missouri Income Tax Calculator Smartasset

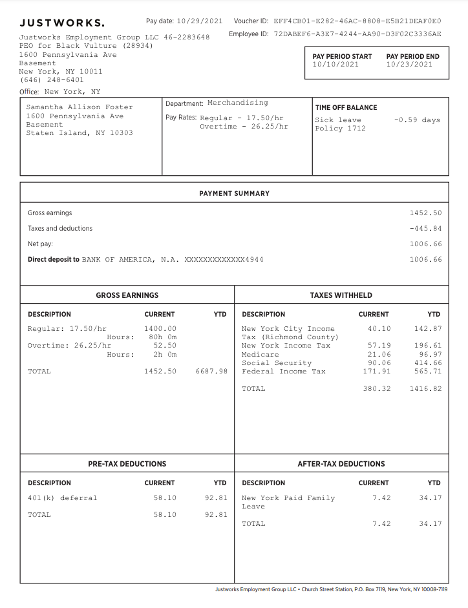

Questions About My Paycheck Justworks Help Center

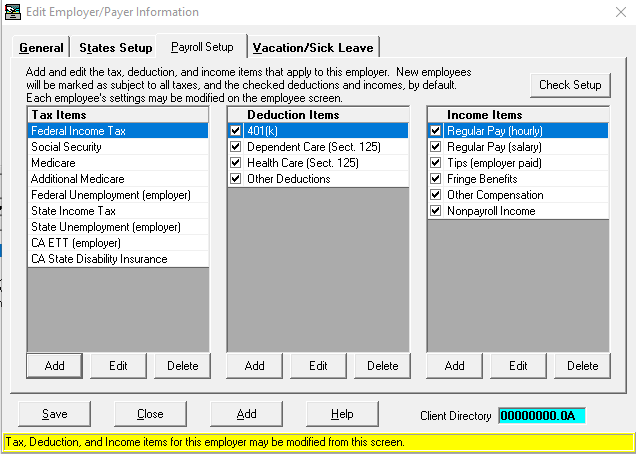

Setting Up Paycheck Items Cfs Tax Software Inc