2021 ev tax credit rules

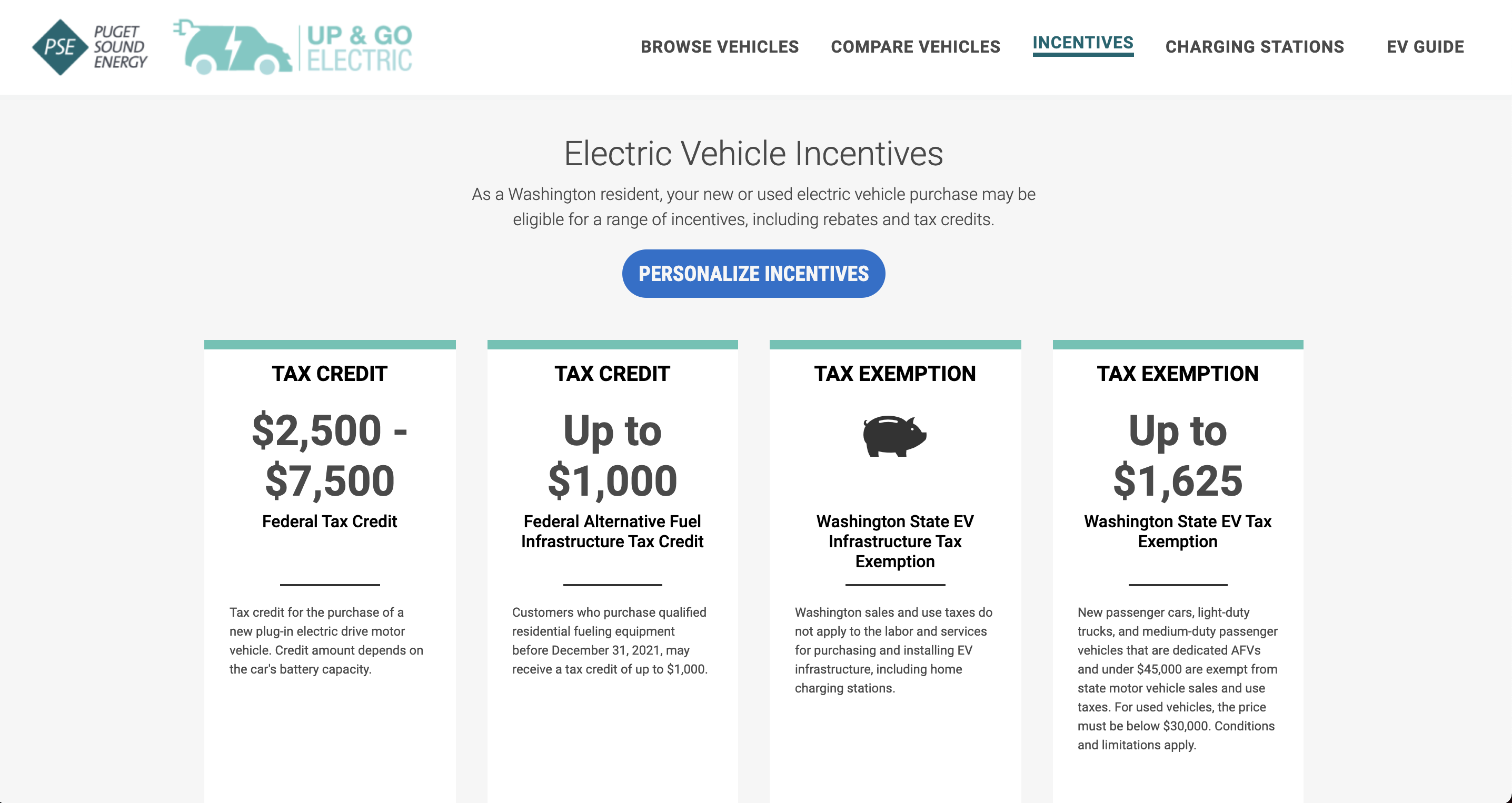

The credit amount will vary based on the capacity of. Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks.

Inside Clean Energy Electric Vehicles Are Having A Banner Year Here Are The Numbers Inside Climate News

New Rules 2022 Beyond For Electric Vehicle EV Tax Credits.

. 2 days agoThe IRA includes a tax credit of up to 7500 at the point of sale for new EVs under Section 30D of the Internal Revenue Code ie the consumer EV tax credit. Non-cars vans trucks SUVs need to be under 80000 to be. 13 hours agoCars That Qualify for the New Federal EV Tax Credit.

This nonrefundable credit is. How much is the new EV tax credit. This requirement went into effect on August 17 2022.

The new tax credits replace the old incentive. 421 rows All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Beginning on January 1 2022.

For vehicles acquired after. The IRS tax credit for 2022 ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. On January 1st used EVs priced 25000 or less will be eligible for a 4000 tax credit or 30 of the sales price whichever is lower.

Since the US added EV tax. Written by Diane Kennedy CPA on August 29 2022. US congressional leaders have agreed to a bill that would expand the existing 7500 new EV tax credit while introducing the first federal tax credit for used EVs.

The new credits will be 7500 for new vehicles and 4000 for used vehicles and will apply to the purchase of EVs plug-in hybrids. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. The new IRA of 2022 bill also allows for an EV tax credit.

Used EVs will get a tax credit. Simply put the Inflation Reduction Act includes a 7500 tax credit at the point of sale for new EVs and 4000 for used EVs. Section 30D of the Internal Revenue Code offers a credit for Qualified Plug-in Electric Drive Motor Vehicles such as passenger cars and.

The rules are complicated but this list of Tesla GM Ford and other cars should make it clearer. The EV tax credit is currently a nonrefundable credit so the government does not cut you a check for the balance. The exceptions are Tesla and General Motors whose.

How Do Electric Car Tax Credits Work Kelley Blue Book

Biden To Sign Law On Tuesday Cutting Most Current Ev Credits Reuters

Why The New Federal Tax Credit Rules May Just Kill The Ev Incentive For Good

Ev Tax Credit Boost At Up To 12 500 Here S How The Two Versions Compare

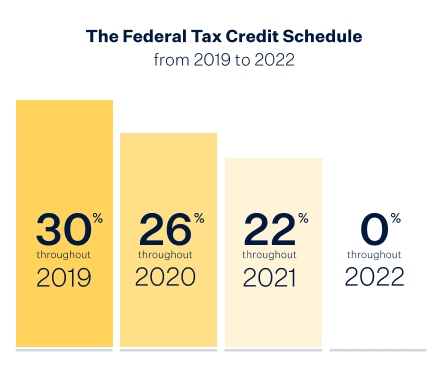

Solar Rebates 2021 Update Federal And Residential Solar Rebates Incentives Sunrun

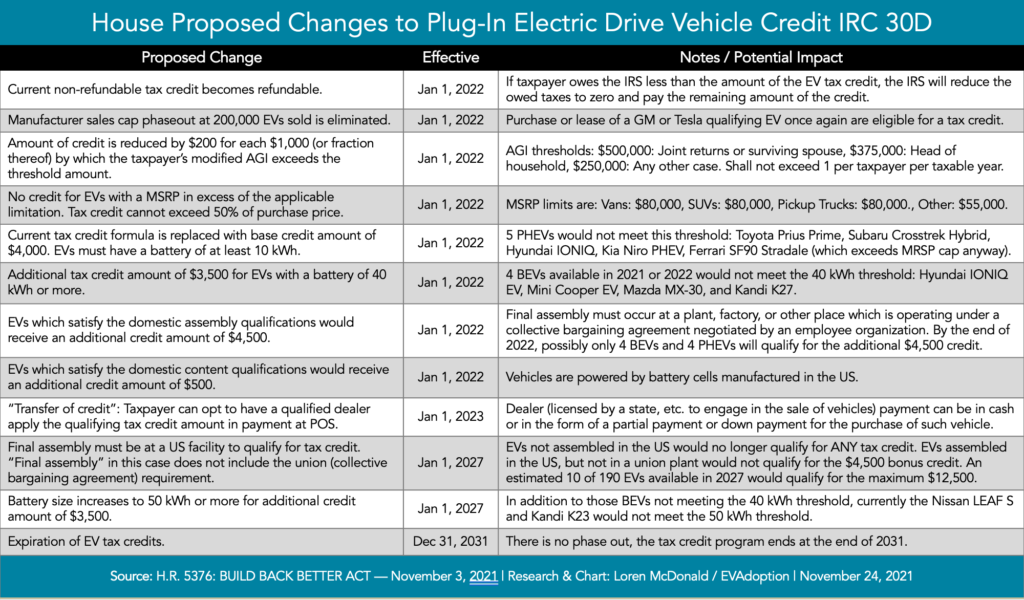

Impact Of Proposed Changes To The Federal Ev Tax Credit Part 1 Summary Chart Evadoption

Which Electric Cars Are Still Eligible For The 7 500 Federal Tax Credit News Cars Com

Electric Cars For Everyone Not Unless They Get Cheaper The New York Times

Ev Tax Credit Gets Surgery But There Are Complications Automotive News

Fixing The Federal Ev Tax Credit Flaws Redesigning The Vehicle Credit Formula Evadoption

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Explained The Updated Ev Tax Credit Rules

Will Inflation Reduction Act Give Tax Credit For Electric Vehicles Deseret News

What To Know About The Complicated Tax Credit For Electric Cars Npr

Proposed Us Ev Tax Credit Gets Global Pushback Business And Economy News Al Jazeera

Biden Admin Says About 20 Models Will Still Qualify For Ev Tax Credits Techcrunch

Proposed Changes To The Federal Ev Tax Credit Passed By The House Of Representatives Evadoption

Ev Tax Credits Explained How Ev Tax Credits Work Krystal A Cpa Youtube